The following transactions and information pertain to Yates Corporation for 2009 and 2010.

2009

May 1 Purchased 3,000 shares of Templin Corporation common stock at per share representing 2 percent of Templin's total outstanding stock) as a long-term investment.

Sept. 1 Received a cash dividend from Templin equal to per share.

Dec. 31 Market value of Templin stock at year end was per share.

2010

Sept. 1 Received a cash dividend from Templin equal to per share.

Nov. 1 Sold 300 shares of Templin at per share.

Dec. 31 Market value of Templin stock at year end was per share.

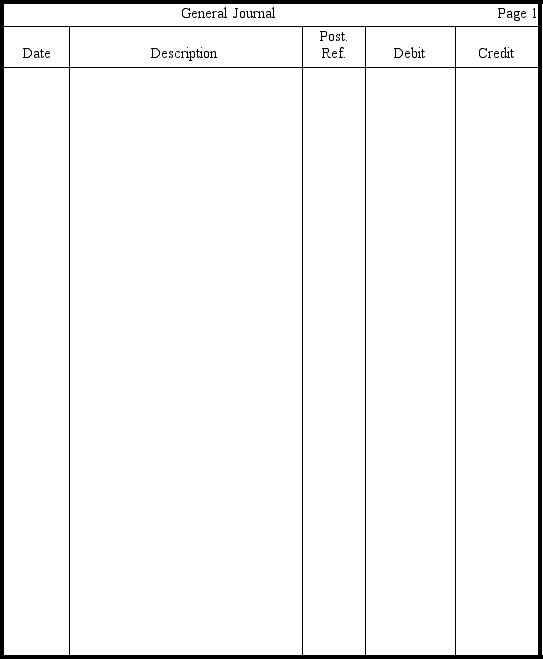

Prepare entries in journal form,without explanations,to record the above.Yates's accounting year ends December 31.

Definitions:

Q33: A corporation probably does not know who

Q71: When bonds are converted to common stock,what

Q86: The entry to close the Dividends

Q103: The following amounts were reported by

Q105: Which of the following items will not

Q114: Available-for-sale debt securities are valued on the

Q115: If only common stock is outstanding,total stockholders'

Q116: When callable preferred stock is called and

Q144: Beckham Corporation has 3,000 shares of $100

Q223: For tax purposes,small businesses may expense the