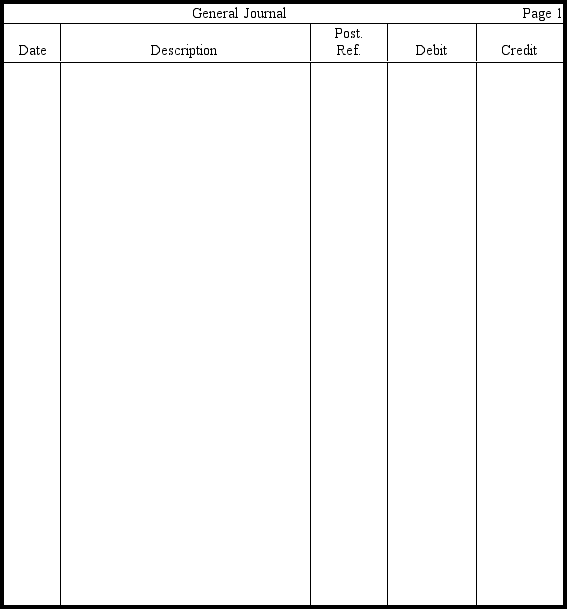

Using the journal provided,enter the following transactions for LaPana Corporation for 2009 and 2010.Please provide all explanations.

2009

Aug. 13 Purchased 1,000 shares of Casper Corporation stock for . These securities were purchased primarily for trading purposes.

Oct. 5 Purchased 4,000 shares of Tally Corporation stock for . These securities were purchased primarily for trading purposes.

Nov. 1 Invested in 120 -day U.S. Treasury bills that have a maturity value of .

Dec. 31 The market value of the Casper Corporation shares is , and the market value of the Tally Corporation stock is . A year-end adjustment is made.

31 A year-end adjustment is made for accrued interest on the Treasury bills.

2010

Mar. 1 Received maturity value of U.S. Treasury bills in cash.

Apr. 14 Sold all 1,000 shares of Casper Corporation stock for .

Sept. 22 Received dividends of per share from Tally Corporation.

Dec. 31 The market value of the Tally Corporation shares is . A year-end adjustment is made.

Definitions:

Consciously Perceive

The act of becoming aware of something through the senses in a mindful and intentional manner.

Hollow Face Illusion

An optical illusion where a concave face appears as a normal convex face due to the brain's interpretation of facial features.

Dual Processing

The theory that the brain operates through both conscious and unconscious thought processes simultaneously.

Selective Attention

The focusing of conscious awareness on a particular stimulus.

Q38: If the indirect method is used to

Q89: Consolidated financial statements are useful because<br>A) investors

Q90: If $110,000 of 12 percent bonds

Q95: Which of the following entries would not

Q117: A stock split results in a transfer

Q127: The year-end adjusting entry to reflect an

Q136: It is the bondholder rather than the

Q141: The following transactions and information pertain

Q153: When a subsidiary has borrowed cash from

Q156: Prepare a corporate income statement in