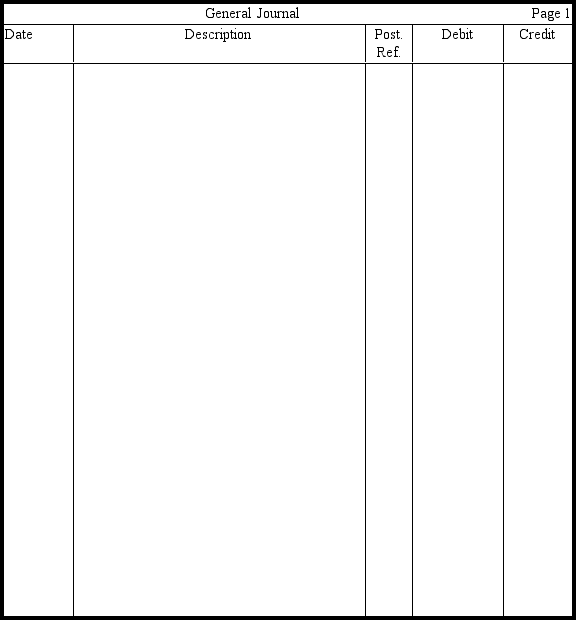

Kagel Corporation had 30,000 shares of $5 par value common stock issued and outstanding on December 31,2009.Each share was issued during 2007 at $14 per share.Prepare the entries in journal form without explanations for the following transactions occurring in 2010:

Jan. 4 Purchased 5,000 shares of treasury stock for per share. This is the first transaction involving its own stock ever engaged in by the company.

31 Sold 1,000 shares of treasury stock for \$15 per share.

Feb. 20 Sold 1,000 shares of treasury stock for per share.

Mar. 16 Sold 1,000 shares of treasury stock for per share.

Apr. 5 Retired 2,000 shares of treasury stock.

May 8 Purchased 500 shares of treasury stock for per share.

31 Retired the 500 shares of treasury stock purchased on May 8 .

Definitions:

Expected Return

The mean of all potential outcomes for an investment, adjusted based on the probability of each scenario occurring.

Standard Deviation

A metric assessing how much a group of data points or investment yields spread out or differ from each other.

Investment Opportunity Set

The range of possible investment options available to an investor, based on their risk tolerance and investment objectives.

Efficient Frontier

A graph representing the set of portfolios that provides the highest expected return for a defined level of risk or the lowest risk for a given level of expected return.

Q13: Use this information to answer the

Q38: Match each of the following terms with

Q41: Earnings per share information need not be

Q50: Orlov Corporation purchased 22,000 shares of

Q53: Barker Company purchased 100 percent of Coll

Q65: A machine that cost $36,000 and on

Q71: Equipment is purchased for $120,000.It has a

Q81: If Rex Corporation issued Ten bonds

Q149: Distinguish between the financial statement presentation of

Q178: Bondholders share voting rights with stockholders.