Dennis Corporation entered into a long-term lease for a piece of equipment.The lease term calls for an annual payment of $2,000 for six years,which approximates the useful life of the equipment.Assume a discount factor of 16 percent.(Note: Present value of a single sum factor at six years and 16% is 0.410; present value of an annuity factor at six years and 16% is 3.685.)Round answers to the nearest dollar.

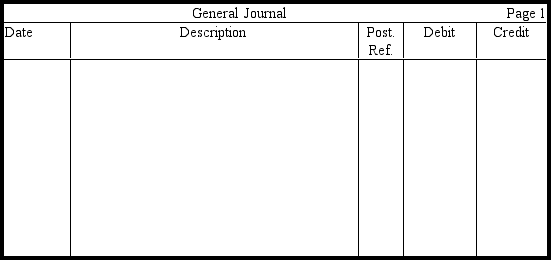

a. Prepare the entry without explanation to record the leased equipment.

b. Prepare the entry without explanation to record annual depreciation, assuming the straight-line method and no residual value.

c. Prepare the entry without explanation to record the first annual payment of $2,000, after the company has had the equipment for one year.

Definitions:

Units Produced

The total number of complete units that are manufactured during a specific period.

Indirect Manufacturing Cost

Costs related to production that cannot be directly attributed to specific products, such as maintenance, utilities, and supervision.

Units Produced

The total number of complete products that are manufactured or processed by a company within a specific period.

Period Costs

Period costs are expenses that are not directly tied to the production process and are charged to the accounting period in which they are incurred, such as sales and administrative expenses.

Q1: The market interest rate is also called

Q12: Promotional costs,such as coupons and rebates,should be

Q79: In its 2010 annual report,Gamma Company indicated

Q81: On November 19,2009,Lassen Company purchased 30,000 shares

Q90: A company receives $100,of which $4

Q109: Dividends in arrears cannot exist in conjunction

Q116: Fabian Company is considering the purchase of

Q126: One argument in favor of accelerated depreciation

Q126: A corporation often uses an underwriter for

Q149: If the purchase of machinery is treated