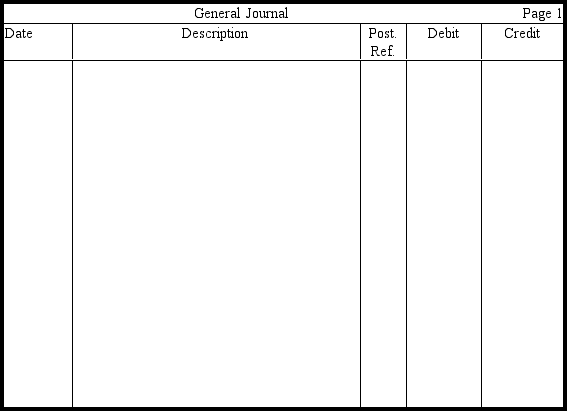

In the journal provided,prepare entries for the following independent transactions.(Omit explanations.)

a. Purchased land and a building on the land for $960,000. The appraised values of the land and building are $350,000 and $650,000, respectively.

b. Paid $5,000 for a sewage system, $15,000 for a parking lot, $1,000 to tear down a shack on land just purchased, and $10,000 for a block wall.

c. Purchased a truck two years ago for $18,000 with an original six-year estimated useful life and $3,000 residual value. After a full two years of use, revised the residual value to $4,000 and the useful life to a total of seven years. Record depreciation for year 3, assuming the straight-line method.

d. Purchased a machine on May 1, 2010 (assume a calendar-year accounting period) for $15,000. The machine has an estimated life of 10,000 hours and no salvage value. Record depreciation for 2010 under the production method, assuming that the machine was used 2,000 hours.

Definitions:

Radical Reconstruction

The period after the American Civil War when the federal government took extensive measures to reintegrate and rebuild the Southern states, and to grant rights to freed slaves.

Interracial Governments

Governmental bodies or systems that include members of different racial or ethnic groups, particularly within contexts of diversity and inclusion.

Carpetbaggers

Derisive term for northern emigrants who participated in the Republican governments of the Reconstruction South.

Scalawags

A derogatory term used during the Reconstruction era to describe southern whites who supported the Republican Party's reconstruction policies.

Q31: A check that is outstanding for two

Q78: Under the allowance method,when a year-end adjustment

Q82: On December 31,2009,the balance sheet of Gamma

Q87: Estimated residual value is ignored entirely under

Q97: Under the allowance method,Uncollectible Accounts Expense is

Q105: Use this information to answer the

Q125: A major criticism of the FIFO method

Q140: When bonds are converted to stock,no gain

Q176: Because accounting measures should be verifiable,liabilities should

Q209: Leasehold improvements become the property of the