Bob Quinn is in the gravel business and has engaged you to assist in evaluating his company,Quinn Gravel Company.Your first step is to collect the facts about the company's operations.On January 3,2010,Bob purchased a piece of property with gravel deposits for $3,155,000.He estimated that the gravel deposits contained 4,700,000 cubic yards of gravel.The gravel is used for making roads.After the gravel is gone,the land,which is in the desert,will be worth only about $100,000.

The equipment required to extract the gravel cost $726,000.In addition,Bob had to build a small frame building to house the mine office and a small dining hall for the workers.The building cost $76,000 and will have no residual value after its estimated useful life of ten years.It cannot be moved from the mine site.The equipment has an estimated useful life of six years (with no residual value)and also cannot be moved from the mine site.

Trucks for the project cost $154,000 (estimated life,six years; residual value,$10,000).The trucks,of course,can be used at a different site.

Bob estimated that in five years all the gravel would be mined and the mine would be shut down.During 2010,1,175,000 cubic yards of gravel were mined.The average selling price during the year was $1.33 per cubic yard,and at the end of the year 125,000 cubic yards remained unsold.Operating expenses were $426,000 for labor and $116,000 for other expenses.

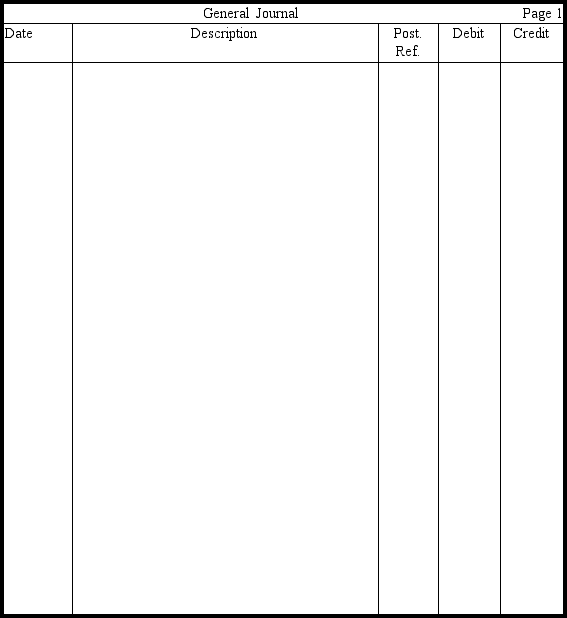

a. Prepare adjusting entries to record depletion and depreciation for the first year of operation (2010). Assume that the depreciation rate is equal to the percentage of the total gravel mined during the year, unless the asset is movable. For movable assets, use the straight-line method. (Omit explanations.)

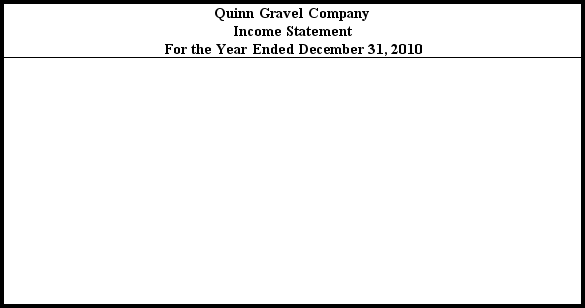

b. Prepare an income statement for 2010 for Quinn Gravel Company.

c. What is your evaluation of the company's operations? Explain your evaluation and offer suggestions. Ignore income tax effects.

Definitions:

Accounts Receivable

Amounts owed to a business by its customers for goods or services that have been delivered but not yet paid for.

Receivables Turnover Ratio

A financial metric that measures how efficiently a company collects cash from credit customers.

Sales Returns

Goods returned by customers to the seller after the sale has occurred, typically due to defects or dissatisfaction.

Allowances

Reductions or adjustments to the carrying amount of assets or the amount of a liability, often related to accounts receivable or inventory to reflect possible uncollectibility or diminution in value.

Q22: Which of the following typically would not

Q45: The term cost flow refers to the

Q74: Suffolk Corporation issued $100,000 of 20-year,6 percent

Q78: Under the allowance method,when a year-end adjustment

Q95: Assume that a company received $1,200

Q124: The balance in Allowance for Uncollectible Accounts

Q142: Failure to record a liability probably will<br>A)

Q158: Depreciation for tax purposes is identical to

Q163: When bonds are converted to common stock,which

Q167: The responsibility for receiving the proper amount