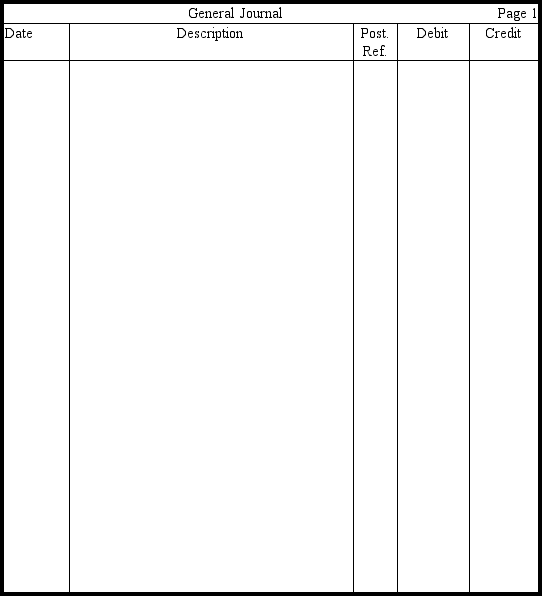

Prepare journal entries without explanations for the following transactions involving notes payable for Gomez Company,whose fiscal year ends June 30.

Definitions:

Work In Process Inventory

Goods that are in the process of being manufactured but are not yet complete.

Fixed Overhead Costs

Regular, unchanged costs incurred by a business, regardless of its level of production or activity, such as rent and salaries.

Control Perspective

An approach focusing on the monitoring and adjusting of processes and strategies to achieve desired outcomes or objectives.

Revenue Variance

The difference between how much the revenue should have been, given the actual level of activity, and the actual revenue for the period. A favorable (unfavorable) revenue variance occurs because the revenue is higher (lower) than expected, given the actual level of activity for the period.

Q24: Product warranties are an expense of the

Q47: Use this inventory information for the

Q86: Hooper Corporation has bonds outstanding with

Q122: Which of the following terms best describes

Q131: Chancellor Company purchased merchandize worth $900

Q134: The payables turnover is the number of

Q134: A $50,000 bond issue with a

Q136: A commitment is a legal obligation that

Q168: The use of major credit cards requires

Q169: The classification of a liability as current