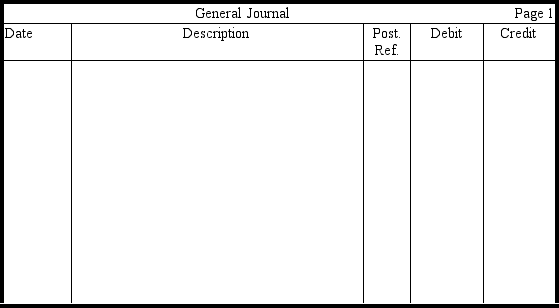

In the journal provided,prepare entries for the following (assume a calendar-year accounting period): Omit explanations.

Dec. 1Received a three-month, 15 percent note receivable for from a customer as an extension of his past-due account.

31 Made the year-end adjustment for accrued interest.

Mar. 1Received full payment on the note.

Definitions:

Units

A measurement or quantity of something, often used in the context of production, sales, or inventory.

LIFO Liquidation

A situation where older inventory, costed at historical prices, is sold, possibly resulting in higher reported profits due to inflation.

Pre-tax Effect

The impact on financial results before the adjustment for taxes has been made.

Units

In accounting and financial reporting, it can refer to a measure of quantity, such as items sold or produced.

Q3: An overstatement of beginning inventory results in<br>A)

Q17: Under the perpetual inventory system,cost of goods

Q41: Grannis Corporation purchased land adjacent to its

Q54: Kotter Mining Company purchases a gravel pit

Q62: Use this information to answer the

Q64: State the definition of a current asset.

Q68: Which of the following statements is true

Q90: Which of the following inventory methods when

Q113: Equipment was purchased for $78,000.It had an

Q135: Use this information to answer the