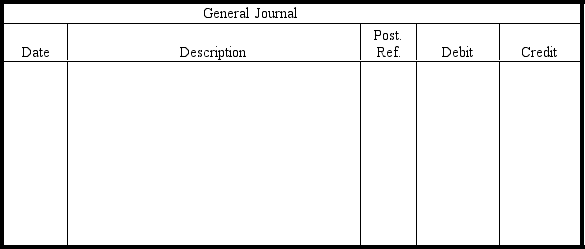

Assume that the sales made by Wessling Corporation for the month ended February 28,20xx,were made to customers using credit cards and totaled $5,666.Prepare one journal entry to record these sales assuming that all of the credit card companies charge Wessling Corporation a 2.5 percent discount fee.(Omit date.)Round to the nearest whole dollar.

Definitions:

Call Option

A fiscal arrangement allowing the buyer to purchase an asset at an agreed-upon price within a certain period, without the requirement to proceed with the purchase.

Call Premium

The amount by which the price of a call option exceeds its intrinsic value, often reflecting the time value of the option.

Put Option

An agreement in finance allowing the owner to sell a certain quantity of an underlying asset at a set price during a specific period, without being compelled to do so.

Strike Price

The pre-determined price at which the holder of an option can buy (in the case of a call option) or sell (in case of a put option) the underlying asset.

Q53: Why would a large company probably benefit

Q58: Each of the following statements is justified

Q77: Using the following data,prepare a multistep

Q92: On June 3,Maryland Company purchased merchandize

Q124: Which of the following is an inventory

Q152: Use this information to answer the

Q156: Both the allowance method and the direct

Q160: All systems of internal control are identical

Q190: The going concern assumption is not applied

Q245: Given the adjusted trial balance below,prepare