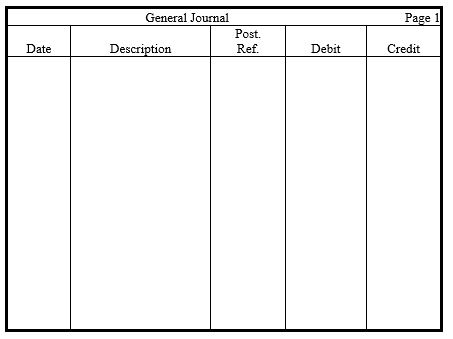

In the journal provided,prepare adjusting entries for the following items.Omit explanations.

a. Depreciation on machinery is $940 for the accounting period.

b. Interest incurred on a loan but not paid or recorded is $635.

c. Office supplies of $600 were on hand at the beginning of the period. Purchases of office supplies during the period totaled $200. At the end of the period, $140 in office supplies remained.

d. Commissions amounting to $540 were earned but not recorded or collected by year end.

e. Prepaid Rent had an $8,000 normal balance prior to adjustment. By year end, 50 percent had expired.

f. Federal income taxes for the year are estimated to be $3,250.

Definitions:

Insurable Interest

A requirement that a person seeking to purchase an insurance policy must have a stake in the well-being of the person or property insured.

Endorsement

The signing of one’s name on the back of a negotiable instrument for the purpose of negotiating it to another.

Premiums

Payments made regularly to an insurance company in exchange for coverage, representing the cost of the insurance policy.

Co-insurance Clause

A provision in insurance policies requiring the policyholder to bear a portion of the loss by maintaining coverage of a specified percentage of the value of the property to receive full reimbursement.

Q19: All of the following are considered nonexchange

Q26: In the journal provided,prepare journal entries

Q47: Which account that does not appear on

Q56: Monty Milko is the only accountant employed

Q65: The work sheet is prepared after the

Q71: Use this information to answer the following

Q95: Which of the following accounts is not

Q147: A company's management information system is a

Q165: Record the following transactions,using proper form,in

Q244: Which of the following is the most