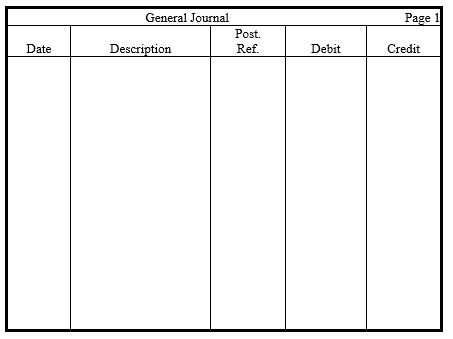

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Definitions:

Trust

The belief in the reliability, truth, ability, or strength of someone or something.

Eating Disorders

Mental disorders characterized by abnormal or disturbed eating habits, which negatively affect a person's health and well-being.

Body-Image Distortions

Misconceptions or misperceptions about one's own body size, shape, or appearance, often associated with eating disorders and body dysmorphic disorders.

Steroids

Organic compounds with four rings arranged in a specific molecular configuration, used in medicine and also known for their performance-enhancing effects in sports.

Q1: The work sheet is a type of

Q5: The best definition of assets is the<br>A)

Q56: For each item below,indicate whether a debit

Q71: Use this information to answer the following

Q75: A traditional definition of internal control specifically

Q91: Use the following unadjusted trial balance

Q100: For each of the following oversights,state whether

Q109: The board of directors carries out the

Q153: Demmler Corporation entered into the transactions listed

Q187: Explain why the dollar amount of total