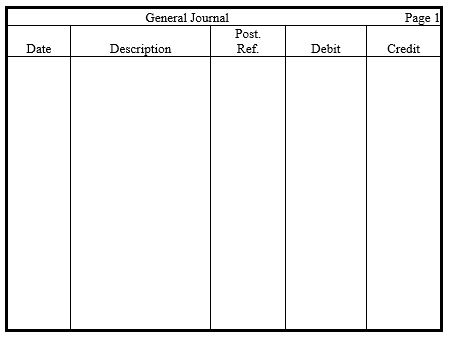

In the journal provided,prepare adjusting entries for the following items.Omit explanations.

a. Unrecorded interest on savings bonds is $680.

b. Property taxes incurred but not paid or recorded amount to $540.

c. Legal fees of $5,000 were collected in advance. By year end, 80 percent were still unearned.

d. Prepaid Insurance had a $1,600 debit balance prior to adjustment. By year end, 25 percent was still unexpired.

e. Salaries incurred by year end but not yet paid or recorded amounted to $1,375.

f. Services totaling $900 have been performed but not yet recorded or billed.

Definitions:

Q17: Which of the following accounts probably would

Q21: The two parts of a corporation's stockholders'

Q45: The entry to record payment of a

Q51: An advantage of the single-step income statement

Q65: The purpose of the ledger is to<br>A)

Q79: Here is the trial balance for

Q85: Investors and creditors use financial statements to

Q126: Which of the following statements is false

Q152: Why is the Dividends account increased by

Q156: To understand accounting information,users must be familiar