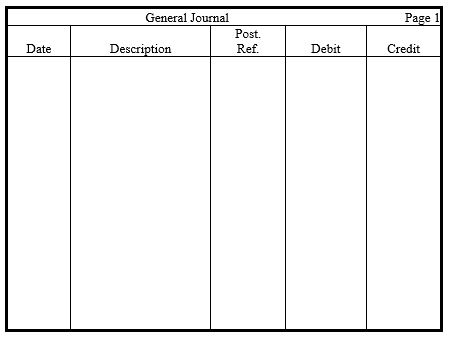

In the journal provided,prepare year-end adjustments for the following situations.Omit explanations.

a. Accrued interest on notes receivable is $560.

b. Of the $7,200 received in advance of earning a service, one-third was still unearned by year end.

c. Two years of rent, totaling $24,000, was paid in advance. By year end, four months' worth had expired.

d. Services totaling $685 had been performed, but not yet billed.

e. Depreciation on trucks totaled $1,700 for the year.

f. Supplies available for use during the year amounted to $3,400. However, by year end, only $700 in supplies remained.

g. Payroll for the five-day work week, to be paid on Friday, is $6,000. Year end falls on a Tuesday.

h. Estimated federal income taxes were $2,100.

Definitions:

Schedule C

A tax form used by sole proprietors to report income and expenses from a business.

Actual Expenses

Real, documented expenses incurred for a specific purpose, often used for tax deduction calculations.

Local Benefits

Refers to services or advantages provided by local government or community organizations to their residents.

Real Property Taxes

Taxes imposed by local governments on real estate properties based on their assessed value.

Q13: What is the essential difference between Keynesian

Q14: When a company purchases goods that it

Q27: Exchange rates for currency change daily according

Q32: Which of the following accounts most likely

Q80: The retained earnings figure is typically divided

Q126: Use this information to answer the following

Q151: All of the following are the goals

Q156: To understand accounting information,users must be familiar

Q158: Which of the following is a condition

Q169: A purchase order is sent from a