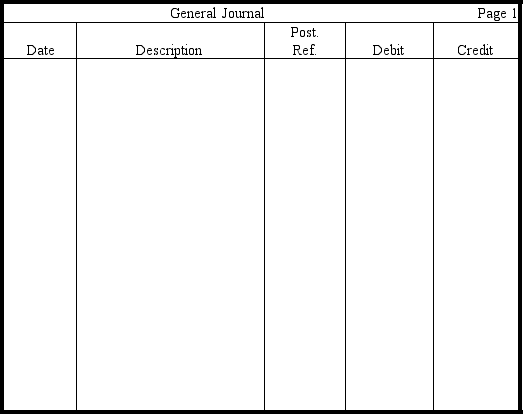

Prepare closing entries for December from the following Income Statement columns of the work sheet of Custom Cleaning Service,Inc.,assuming that a $500 dividend was paid during the period (omit explanations).

Definitions:

Discount Rate

In discounted cash flow analysis, this is the rate used to ascertain the present worth of cash flows expected in the future.

Tax Rate

The tax imposition rate on the financial gains of individuals and corporations.

Machinery

Tools, equipment, and devices that perform various tasks in the production process, often indicating the fixed assets used in manufacturing or production.

Equipment

Tangible items purchased for use in the production or supply of goods and services, not intended for sale as part of regular operations.

Q7: Accounting information contains numerous estimates,classifications,summarizations,judgments,and allocations.

Q12: The Securities and Exchange Commission is an

Q32: Here is the trial balance for

Q35: All of the following,except one,were policies supported

Q63: If a debit to Supplies were posted

Q63: Accountants consider money the common unit of

Q111: Colton,Inc.,a specialty retailer of customized audio systems

Q122: Accounts Receivable and Accounts Payable are used

Q124: A liability would not include an obligation

Q162: The heading for a balance sheet might