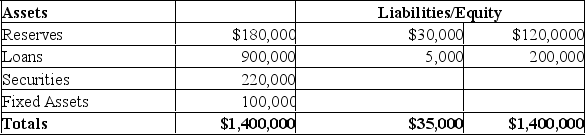

The following table shows the balance sheet for all banks combined in the banking system.All banks have a target reserve ratio of 12.5 percent.

a)What is the amount of excess reserves.

a)What is the amount of excess reserves.

b)What is the maximum amount that loans and deposits can be increased?

c)If the banking system were fully loaned up,by how much will the money supply have increased?

Definitions:

Yield To Maturity

The total return expected on a bond if held until its maturity date, considering all interest payments and the principal repayment.

3-Year Bond

A debt security issued by an entity that matures in three years from the date of issuance, indicating the length of time before the principal is repaid.

Forward Rate

The agreed-upon rate for a financial transaction that will occur at a future date, often used in foreign exchange and interest rate markets.

Coupon Rate

The annual interest rate paid on a bond, expressed as a percentage of the bond's face value.

Q6: Refer to the graph above to answer

Q13: What is the difference between the M1

Q49: Refer to the information above to answer

Q62: The velocity of money refers to the

Q78: Which of the following is true of

Q95: All of the following items,except one,are part

Q125: What are Canada's main exports?

Q131: Assume that the economy is at full

Q146: What does autonomous consumption refer to?<br>A)The level

Q179: Refer to the figure above to answer