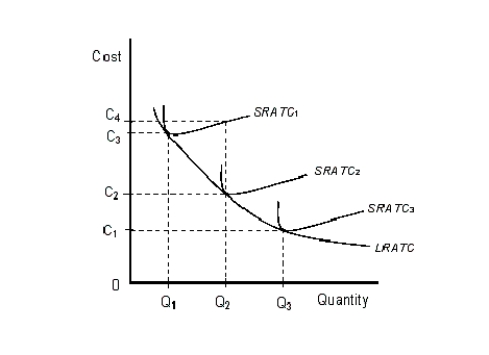

The figure given below shows three Short Run Average Total Cost (SRATC) curves and the Long Run Average Total Cost (LRATC) curve of a firm.Figure 8.3

-The difference between average total cost and average variable cost decreases with an increase in output.

Definitions:

Night Terrors

A sleep disorder causing feelings of panic or dread, typically occurring during non-REM sleep stages and resulting in loud screams or movements.

Cause

A reason or motivation for an action or event.

Suffer

To experience or be subjected to something bad or unpleasant.

Cultural Differences

The variations in the ways of life, beliefs, norms, and behaviors among different groups of people or societies.

Q29: Refer to Figure 10.3 and identify the

Q46: A fall in the average income of

Q48: A monopolistically competitive firm may earn above

Q49: What do you mean by the term

Q52: When the government's spending is less than

Q56: Assume that the price elasticity of demand

Q72: As the price of a good increases,

Q93: If a 15 percent reduction in the

Q104: Refer to Figure 12.3. A perfectly competitive

Q123: Consumer equilibrium exists when the marginal utility