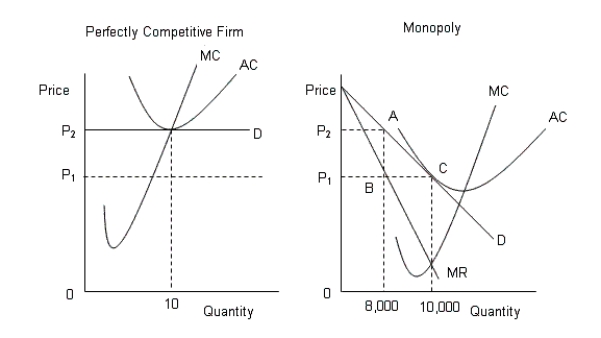

The following figures show the demand and cost curves of a perfectly competitive firm and a monopoly respectively.Figure 11.7

D: Average Revenue

D: Average Revenue

AC: Average cost

MC: Marginal cost

MR: Marginal cost

-Why does an efficiency loss arise under monopoly rather than under perfect competition?

Definitions:

Debt to Equity

A financial metric showing the comparative amount of debt and shareholders' equity utilized to fund a company's assets.

Price/Earnings

A valuation ratio of a company's current share price compared to its per-share earnings, used to assess if a stock is over or undervalued.

Ratio Analysis

A technique of analyzing the strength of a company by forming (financial) ratios out of sets of numbers from the financial statements. Ratios are compared with the competition, recent history, and the firm’s plan to assess the quality of its performance.

Stable Company

Refers to a firm with consistent performance, low volatility in its stock price, and predictable financial returns, making it a less risky investment.

Q33: In Figure 14.5, the firm is:<br>A)a monopsonist

Q45: The long-run average-total-cost curve connects the lowest

Q67: The labor demand curve is based on

Q85: Which of the following does the Sherman

Q88: According to Figure 12.1, the profit-maximizing firm

Q99: According to Table 12.2, if firm A

Q113: Private costs of an economic activity exceed

Q115: Refer to Table 10.1. If the market

Q128: In the short-run, a perfectly competitive firm

Q138: Buyers who are persuaded to take a