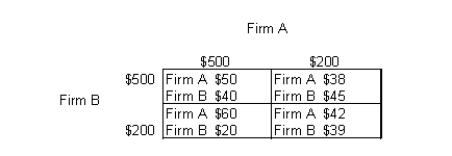

The table below shows the payoff (profit) matrix of Firm A and Firm B indicating the profit outcome that corresponds to each firm's pricing strategy (where $500 and $200 are the pricing strategies of two firms) .Table 12.2

-Why do externalities arise?

Definitions:

Present Value

The current financial valuation of a sum of money due in the future or stream of income, based on a specific interest rate.

Future Value

The worth of an investment or cash flow at a specified future date, based on an assumed rate of growth over time.

Opportunity Cost

Opportunity cost refers to the potential benefits an individual, investor, or business misses out on when choosing one alternative over another.

Resource

In finance, a resource refers to any financial asset or input that can contribute to a firm's ability to create goods, services, or further financial gains.

Q3: If significant barriers to entry exist in

Q24: If a person is earning $80,000 per

Q34: In Figure 9.3, if the marginal revenue

Q35: After hiring 151 units of the variable

Q35: When a perfectly competitive firm's demand curve

Q63: If the coupon-rate of a particular bond

Q64: According to Figure 14.6, if the government

Q70: Refer to Figure 11.2. In order to

Q84: A monopolist always produces on the elastic

Q94: A bond with a par value of