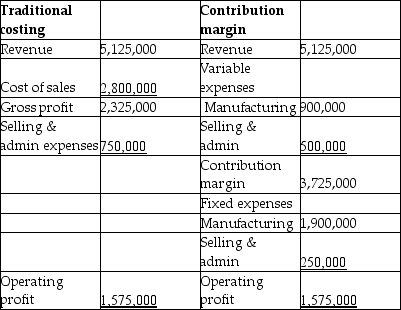

Optus Company makes special equipment used in mobile network towers.Each unit sells for $410.Optus produces and sells 12,500 units per year.They have provided the following income statement data:

A foreign company has offered to buy 75 units for a reduced price of $320 per unit.The marketing manager says the sale will not negatively affect the company's regular sales.The sales manager says that this sale will require incremental selling & administrative costs,as it is a one-time deal.The production manager reports that it would require an additional $25,000 of fixed manufacturing costs to accommodate the specifications of the buyer.If Optus accepts the deal,how will this impact operating profit?

Definitions:

Budgeted Production

The planning of how many units of a product a company aims to produce within a specific period.

Activity-based Budgeting

A budgeting approach based on the activities that incur costs within an organization, focusing on managing business activities that drive costs.

Master Budget

Master budget is a comprehensive financial planning document that consolidates all of a company’s individual budgets related to sales, production, manpower, etc.

Budgets Developed

Refer to the process of creating financial plans for an organization or individual's future operations, typically involving setting goals, estimating revenues, and allocating resources.

Q5: When a business is considering whether to

Q15: The benefit foregone by not choosing an

Q18: If production exceeds units sold,which of the

Q23: Sales commissions are included in manufacturing overhead.

Q23: Demand for U.S. dollars by speculators is

Q24: Jackson Company has provided the following

Q42: Refer to Table 20.4. Producing 1 more

Q46: At the beginning of 2017,Conway Manufacturing

Q71: The exchange rate that is established in

Q121: The capital expenditures budget stands alone and