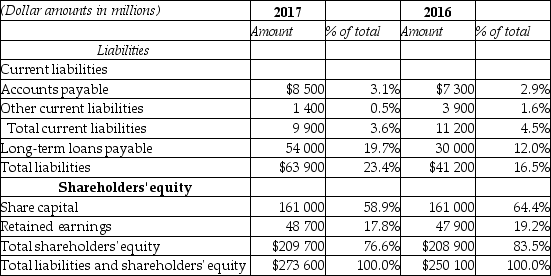

Please refer to the partial balance sheet data provided below:

Which of the following would be a valid conclusion from the above data?

Definitions:

Future Income Tax Rates

Future income tax rates refer to the expected rates at which earnings will be taxed in future periods, relevant for future tax planning and deferred tax calculations.

Deferred Tax Balances

Amounts recorded on the balance sheet to reflect the future tax impact of temporary differences between the accounting and tax treatment of transactions.

Deferred Tax Asset Valuation Allowance

A reserve established against a deferred tax asset when it is likely that some or all of the asset will not be utilized.

Valuation Allowance

An accounting provision made to offset a portion of the deferred tax assets if it's more likely than not that some portion or all of the asset may not be realized.

Q9: Centric Sail Makers manufacture sails for

Q11: Which of the following would NOT be

Q23: Margaret sells hand-knit scarves at a flea

Q38: Please refer to the partial balance sheet

Q39: Rodriguez Ltd uses the indirect method

Q68: JC Manufacturing produces products that use a

Q76: Which of the following balance sheets displays

Q80: Crystal Ltd is a retailer of

Q116: Factory rent,taxes and insurance are included in

Q153: Which of the following best describes the