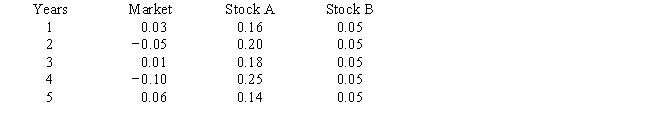

Consider the following average annual returns for Stocks A and B and the Market. Which of the possible answers best describes the historical betas for A and B?

Definitions:

Collectivist Cultures

Societies that prioritize the group over the individual, emphasizing family ties, social harmony, and interconnectedness over personal achievements.

Prevalent

Widespread in a particular area at a certain time; commonly occurring.

Core Of Rogers's Theory

Centers around the concept of self-actualization, which posits that individuals have an inherent tendency towards growth and fulfillment of their potentials.

Self

The total, essential, or particular being of a person; the individual's consciousness and identity.

Q4: Last year Central Chemicals had sales of

Q8: Refer to the data for Pettijohn Inc.

Q15: Assume MetAmbit Ltd had profit of $2500

Q15: Suppose you just won the state lottery,

Q20: An analyst wants to use the Black-Scholes

Q56: Listed below are some provisions that are

Q67: As the assistant to the CFO of

Q74: Ace Ltd had the following transactions in

Q88: The following are the current month's

Q162: Which of the following statements regarding a