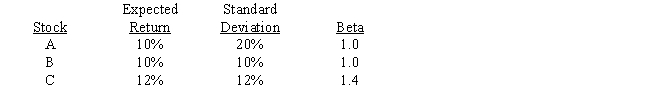

Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1. Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

Definitions:

Equal Chance

The principle that every individual or element in a sample or population has an identical likelihood of being chosen for something, commonly associated with random selection or assignment.

Government Food Vouchers

Financial assistance programs provided by governments to help low-income families purchase food and other essentials.

Hispanic Female

A woman who identifies with a Spanish-speaking culture or heritage, often associated with countries from Latin America or Spain.

Sampling Bias

A bias in which certain members of a population are disproportionally represented in a sample, leading to inaccurate results.

Q3: Braddock Construction Co.'s stock is trading at

Q4: Recently, Hale Corporation announced the sale of

Q29: With which of the following statements would

Q29: The times-interest-earned ratio is one, but not

Q39: Suppose Randy Jones plans to invest $1,000.

Q43: Which of the following statements is CORRECT?<br>A)

Q47: You are considering 2 bonds that will

Q50: Bill Rogers has three different businesses.He has

Q53: Which of the following statements is CORRECT?<br>A)

Q53: Smith borrowed $24 000 on a one-year