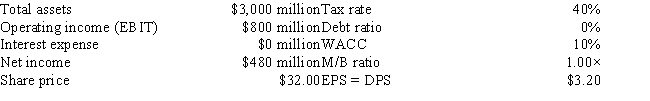

The following information has been presented to you about the Gibson Corporation. The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

Definitions:

Phineas Gage

A railroad worker who survived a severe brain injury in the 19th century, leading to significant insights into brain function and personality change.

Split-Brain Patients

Individuals who have undergone corpus callosotomy, a procedure that severs the corpus callosum, leading to a separation of the brain's hemispheres.

Transcranial Magnetic Stimulation

A noninvasive procedure that uses magnetic fields to stimulate nerve cells in the brain to improve symptoms of depression and other conditions.

Virtual Lesion Method

A research technique that uses non-invasive brain stimulation to temporarily disrupt brain activity in a specific area to study its function.

Q15: If Decker had a financing deficit, it

Q25: Fitzgerald Computers is considering a new project

Q37: A line of credit can be either

Q37: Projects are identified and selected in the<br>A)initiating

Q42: Chambliss Corp.'s total assets at the end

Q43: The RFP should state the required schedule

Q49: Suppose a U.S. firm buys $200,000 worth

Q71: Which of the following statements is CORRECT?

Q94: Consider two projects, X and Y. Project

Q104: On average, a firm collects checks totaling