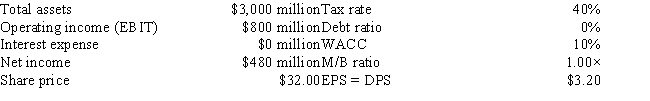

The following information has been presented to you about the Gibson Corporation. The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

Definitions:

Marketing Segmentation

The process of dividing a market into distinct subsets of consumers with similar needs or characteristics, allowing for targeted marketing strategies.

Different Groups

Distinct categories or clusters in which data points are divided based on specific characteristics or treatments.

Confidence

The feeling of trust or belief in someone or something; in statistics, it refers to the degree to which one can be certain in the accuracy of a result.

Proportion

A part, share, or number considered in comparative relation to a whole; a type of ratio.

Q7: You recently sold 200 shares of Apple

Q9: Not taking cash discounts is costly, and

Q10: It is appropriate to use the fixed

Q22: Two firms with identical capital intensity ratios

Q36: The Department of Transportation hired a company

Q67: The reputation of the company that announced

Q70: Which of the following statements is CORRECT?<br>A)

Q77: One problem with ratio analysis is that

Q132: Which of the following actions would be

Q138: Refer to the data for Hardwig, Inc.Assume