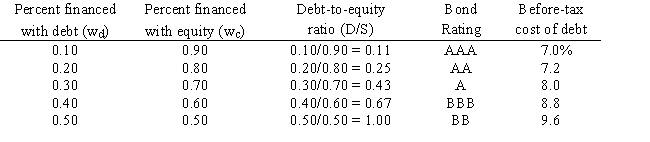

LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. LeCompte estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," bU, equals 1.0.) The company's tax rate, T, is 40%.

On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure?

Definitions:

Revenue Stream

The source of income for a business or organization, which can come from sales, services, investments, or other channels.

Identical Skill Levels

Refers to a situation where individuals or entities have the same level of expertise or competence in a specific domain.

Wage Rate

The fixed amount of compensation or payment received by an employee for employment services, typically expressed per hour or year.

Intense Heat

Extremely high temperatures that can impact environments, health, and activities.

Q4: A request for proposals helps the organization

Q26: Norton Electrical has quite a few positive

Q41: One of the first steps in arriving

Q57: Langton Inc. is considering Projects S and

Q61: The CFO of Cicero Industries plans to

Q62: Your sister paid $10,000 (CF at t

Q64: The project objective requires completing the project

Q67: A project involves degree of uncertainty that

Q69: It is possible that two firms could

Q118: A lockbox plan is most beneficial to