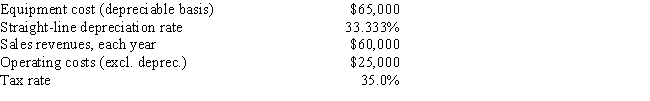

Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's Year 1 cash flow?

Definitions:

Q2: The CEO of D'Amico Motors has been

Q5: As soon as a contractor finds out

Q6: Which of the following would be most

Q13: Materials that would be used for a

Q20: Fixed-price contracts are most appropriate for projects

Q21: Craig's Car Wash Inc. is considering a

Q42: When establishing the project objectives, the objective

Q93: For large or complex projects, it may

Q99: Equipment that is included in the project

Q103: Activities define more generally than work packages