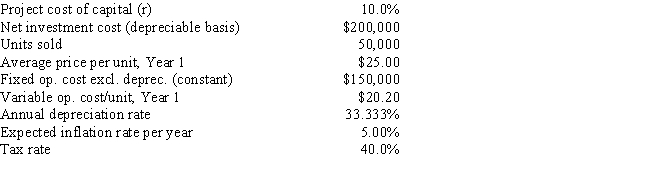

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV?

Definitions:

Efficient-market Hypothesis

The theory that all known information is already reflected in stock prices, making it impossible to consistently achieve higher returns than the overall market.

Security Prices

The current cost or value at which a particular security, such as stocks, bonds, or options, can be bought or sold in the market.

Empirical Validity

The extent to which a theoretical concept is supported by real-world evidence or data.

Information Processing

The acquisition, recording, organization, retrieval, display, and dissemination of information.

Q6: Projects A and B have identical expected

Q16: Which of the following statements is CORRECT?<br>A)

Q22: The project justification includes the key assumptions

Q24: is a structured approach for organizing all

Q28: Which of the following statements is CORRECT?<br>A)

Q43: The regular payback method is deficient in

Q45: With the quality plan in place including

Q56: Although short-term interest rates have historically averaged

Q75: The shows all the individuals associated with

Q95: Which of the following statements is CORRECT?<br>A)