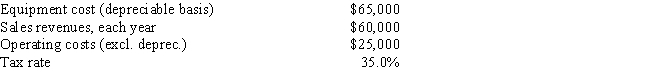

Your new employer, Freeman Software, is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, and the allowed depreciation rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected life. What is the Year 1 cash flow?

Definitions:

Accounts Over 30 Days

Accounts receivable that have not been paid within 30 days of the invoice date, indicating delayed payments.

Receivables Manager

A professional responsible for overseeing and managing a company's accounts receivable to ensure timely collection of owed money.

Receivables-To-Sales Ratio

A financial metric measuring the proportion of a company's receivables relative to its total sales, indicating how efficiently it collects on sales credit.

Payables-To-Sales Ratio

A financial metric that analyzes the relationship between a company's total payables and its total sales.

Q3: You observe that a firm's ROE is

Q6: Projects A and B have identical expected

Q22: Yoga Center Inc. is considering a project

Q22: The project justification includes the key assumptions

Q33: A project objective such as "complete the

Q36: The contractor needs to obtain advance approval

Q40: A company expects sales to increase during

Q41: One of the first steps in arriving

Q44: A project has a sponsor or customer.

Q86: Which of the following statements is CORRECT?