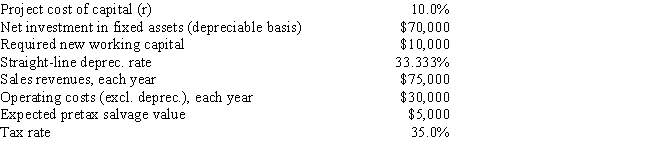

Sheridan Films is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

KeyCite

A citation research service that helps legal professionals verify the authority and validity of legal cases, statutes, and regulations by indicating their history and treatment.

Questioned

To be asked for information or clarification, often in the context of a legal examination or investigation.

Red Flag

A warning signal indicating potential problems or dangers.

Liability

A legal responsibility or obligation, often associated with a claim against someone in a court of law.

Q9: Which of the following statements is CORRECT?<br>A)

Q14: Patterson Co. is considering a project that

Q16: A firm's peak borrowing needs will probably

Q16: Projects are constrained only by the scope,

Q22: Two firms with identical capital intensity ratios

Q33: A Eurodollar is a U.S. dollar deposited

Q33: Describe what it means to "plan the

Q33: MM's dividend irrelevance theory says that while

Q40: If the spot rate of the Israeli

Q67: James must gather information from a potential