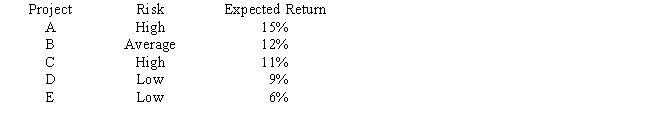

Laramie Labs uses a risk-adjustment when evaluating projects of different risk. Its overall (composite) WACC is 10%, which reflects the cost of capital for its average asset. Its assets vary widely in risk, and Laramie evaluates low-risk projects with a risk-adjusted project cost of capital of 8%, average-risk projects at 10%, and high-risk projects at 12%. The company is considering the following projects: Which set of projects would maximize shareholder wealth?

Definitions:

Elastic

Describes a situation where a change in one variable, such as price, leads to a significant change in another variable, such as demand.

Price Elasticity of Demand

An indicator of consumer sensitivity to price fluctuations, represented by the degree to which the demand for a product varies in response to alterations in its price.

Absolute Value

The distance of a number from zero on a number line, without considering its direction; always a positive number or zero.

Cookies

Small files stored on a user's computer or device by a website, containing data about the user's browsing activities.

Q10: Firms hold cash balances in order to

Q12: It is illegal for the contractor to

Q19: Which of the following statements is CORRECT?<br>A)

Q41: A work breakdown structure shows the necessary

Q53: Century Roofing is thinking of opening a

Q85: Clients want to work with people who

Q86: Which of the following statements is CORRECT?

Q86: The cost of developing a proposal should

Q89: A detailed description of each deliverable will

Q107: The customer may randomly select certain work