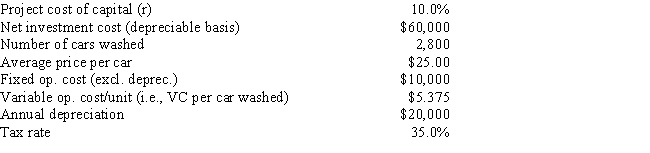

Spot-Free Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3-year tax life, would be depreciated on a straight-line basis over the project's 3-year life, and would have a zero salvage value after Year 3. No new working capital would be required. Revenues and other operating costs will be constant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units. If the number of cars washed declined by 40% from the expected level, by how much would the project's NPV decline? (Hint: Note that cash flows are constant at the Year 1 level, whatever that level is.)

Definitions:

Marginal Cost Curve

A graphical representation showing how the cost to produce one additional unit changes as more units are produced.

Profits

The financial gain realized when the revenue earned from business activities exceeds the expenses, costs, and taxes needed to sustain those activities.

Output

The quantity of goods or services produced by a business, industry, or economy within a specific period.

Shutting Down

A short-run decision by a firm to cease production temporarily due to unfavorable market conditions.

Q9: The cost of capital may be different

Q18: Describe benefits of including the people that

Q36: Because political risk is seldom negotiable, it

Q38: Changes can be initiated by the customer

Q46: Arrows linking the activity boxes in a

Q62: The internal rate of return is that

Q78: Which of the following statements is NOT

Q108: Which of the following statements is CORRECT?<br>A)

Q108: The states the specific deliverable that is

Q117: A network diagram is a tool for