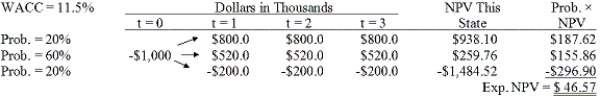

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm?

Definitions:

Comparative Advantage

The ability of an entity to produce goods or services at a lower opportunity cost than others, leading to more efficient trade and production.

Absolute Advantage

Absolute advantage refers to an individual's, firm's, or country's ability to produce more of a good or service than competitors, using the same amount of resources.

Technology

The application of scientific knowledge for practical purposes, especially in industry.

Increasing Returns

A situation in economics where an increase in the scale of production leads to a more than proportionate increase in output, often due to efficiencies gained.

Q4: The calculated cost of trade credit can

Q11: At the beginning of the project it

Q18: Multiple individuals should be designated the lead,

Q28: The company you just started has been

Q34: F. Marston, Inc. has developed a forecasting

Q38: Which of the following statements is CORRECT?<br>A)

Q45: Suppose 1 U.S. dollar equals 1.60 Canadian

Q58: The project title should be a code

Q60: Kasper Film Co. is selling off some

Q61: Since receivables and payables both result from