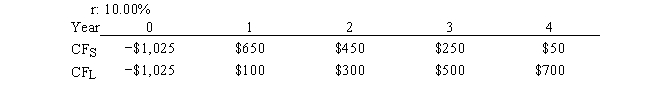

Markman & Sons is considering Projects S and L. These projects are mutually exclusive, equally risky, and not repeatable and their cash flows are shown below. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

Definitions:

Forecasting

The practice of making predictions about future events based on historical and current data.

Cycle-sensitive Decisions

Decision-making that takes into account the cyclical nature of business, markets, or economic conditions, adjusting strategies accordingly.

Consensus Approach

A collaborative decision-making process where all group members agree on a specific outcome or decision.

Highly Motivated

Exhibiting a strong drive and commitment towards achieving specific goals or tasks.

Q1: Latest finish time LF) is the latest

Q24: Suppose Walker Publishing Company is considering bringing

Q32: Two operationally similar companies, HD and LD,

Q51: The project purpose should<br>A)summarize the need and

Q54: The purpose of preparing a request for

Q71: The usually states the time by which

Q72: If the RFP format requirement states a

Q91: Always put the client first.

Q94: Consider two projects, X and Y. Project

Q125: Many projects because of scope creep caused