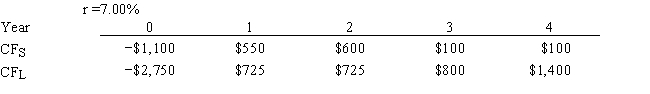

Langton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone. In other words, what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. MIRR will have no effect on the value lost.

Definitions:

Medial

Pertaining to or situated toward the midline of the body or an organ.

Lateral

Pertaining to or situated at the side.

Abdominopelvic Cavity

A body cavity comprising the abdominal and pelvic cavities, housing major organs of digestion, reproduction, and excretion.

Pathophysiology

The study of how disease processes affect the function of the body.

Q2: Which of the following statements is CORRECT?<br>A)

Q20: Fixed-price contracts are most appropriate for projects

Q21: The acceptance criteria deals with the scope

Q29: Refer to the data for Best Bagels,

Q31: The cost of capital for two mutually

Q43: Refer to the data for Pennewell Publishing

Q52: To increase productive capacity, a company is

Q53: Inclusion of an organization chart or assigned

Q61: The CFO of Cicero Industries plans to

Q79: Describe five things that a project manager