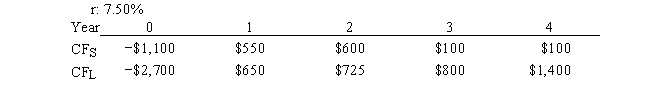

Current Design Co. is considering two mutually exclusive, equally risky, and not repeatable projects, S and L. Their cash flows are shown below. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost.

Definitions:

Cocaine

A powerful and illegal stimulant drug derived from the leaves of the coca plant, known for its addictive properties and ability to increase levels of dopamine in the brain.

AMPA Receptor

The AMPA receptor is a type of glutamate receptor in the central nervous system that plays a crucial role in fast synaptic transmission and plasticity, contributing significantly to learning and memory.

Glutamate

An excitatory neurotransmitter crucial for brain functions including learning and memory, acting as a chemical messenger in the nervous system.

Postsynaptic Membrane

Membrane on the transmitter, or input, side of a synapse.

Q4: Free slack is calculated by finding the

Q5: The at a level of a high

Q12: Which of the following statements is CORRECT?<br>A)

Q15: A project is an endeavor to accomplish

Q18: Which of the following statements is CORRECT?<br>A)

Q25: A ballpark estimate is acceptable for the

Q39: A request for proposal is required for

Q57: An increase in any current asset must

Q65: Management reserves are the estimated costs to

Q136: The average accounts receivable balance is a