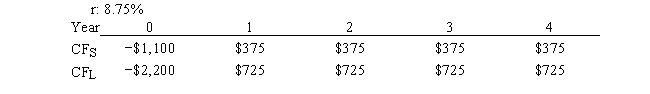

Silverman Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Cost Of Debt

The return that lenders require on the firm’s debt.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset evenly across its useful life.

Resale Value

The estimated amount for which an asset can be sold at the end of its useful life, considering factors like market demand and the asset's remaining utility.

Net Operating Losses

Financial losses that occur when a company's operating expenses exceed its revenues, which can be applied to reduce taxable income.

Q29: If a firm's capital intensity ratio (A<sub>0</sub>*/S<sub>0</sub>)

Q36: The RFP should provide instructions for the

Q44: A project has a sponsor or customer.

Q52: The optimal distribution policy strikes that balance

Q58: A responsibility assignment matrix defines who will

Q65: Suzanne's Cleaners is considering a project that

Q65: Padding estimates with the vision of becoming

Q71: If debt financing is used, which of

Q75: Net operating working capital is defined as

Q86: The cost of developing a proposal should