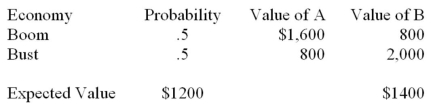

Firm A does well in a boom economy.Firm B does well in a bust economy.The probability of a boom is 50%.The end of period values of the two firms depend on the economy as shown below:  Both firms have debt outstanding with a face value of $1,000.In order to diversify,the two firms have proposed a merger.The NPV of the merger is zero.Which of the following statements is correct?

Both firms have debt outstanding with a face value of $1,000.In order to diversify,the two firms have proposed a merger.The NPV of the merger is zero.Which of the following statements is correct?

Definitions:

Receptors

Biological proteins located on cell surfaces or within cells that bind to specific molecules, triggering a response in the cell.

Sticky Mittens

An experimental tool used in developmental psychology research to explore early infant learning and motor skills development, allowing infants to grasp objects earlier than they would naturally.

Ball Glove

A piece of sports equipment used in baseball and softball to catch balls, made of leather or similar materials.

Velcro

A hook-and-loop fastener system used for temporary bonds, known for its easy attachment and detachment capabilities.

Q7: The Felix Corp.projects to pay a dividend

Q9: The value of a previously purchased building

Q15: Collegiate Tuxedo rents apparel throughout the year.They

Q16: Which of the following is not true

Q18: "A commodity costs the same regardless of

Q21: A convertible bond has an 7% coupon

Q21: Management's first step in any issue of

Q22: For a particular stock the old stock

Q43: Suppose that Walkman stereos sell in the

Q80: Define what is meant by interest rate