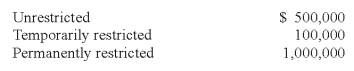

Local Services,a voluntary health and welfare organization had the following classes of net assets on July 1,2008,the beginning of its fiscal year:

During the year ended June 30,2009,the following events occurred:

(1) It purchased equipment,costing $100,000,with contributions restricted for this purpose.The contributions had been received from donors during June of 2008.

(2) It received $130,000 of cash donations which were restricted for research activities.During the year ended June 30,2009,$90,000 of the contributions were expended on research.

(3) It sold investments classified in the permanently restricted class for a loss of $40,000.Dividends and interest income earned on the investments amounted to $70,000.There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses,excluding depreciation expense,for program services and supporting services incurred during the year ended June 30,2009,amounted to $260,000.

(6) Depreciation expense for the year ended June 30,2009,was $80,000.

-Refer to the above information.At June 30,2009,the amount of permanently restricted net assets reported on the statement of financial position would be:

Definitions:

Q3: Chapter 7 of the Bankruptcy Code provides

Q9: A financial manager's most important job is

Q10: A firm has a debt-to-equity ratio of

Q20: Suppose the MiniCD Corporation's common stock has

Q22: List 2 shortcomings of using value at

Q32: The assets listed below of a foreign

Q45: In accordance with the Single Audit Act

Q51: Accountants are liable for any materially false

Q57: A portfolio is made up of 75%

Q100: The governing board designated assets for plant