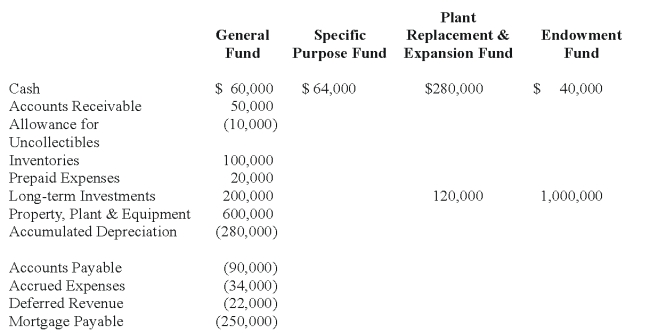

The following information is contained in the funds which are used to account for the transactions of the Hope Hospital,which is operated by a nonprofit,religious organization.The balances in the accounts are as of June 30,2009,the end of the hospital's fiscal year.Credit amounts are in parentheses.

Additional information:

The $64,000 in the specific purpose fund is restricted for research activities to be conducted by the hospital.

Required:

Prepare a balance sheet for Hope Hospital as of June 30,2009.

Definitions:

Corporate Tax

A tax imposed on the income or profit of corporations and other business entities.

35%

This is often a reference to a specific tax rate, percentage rate of interest, or any other figure that is quantified at 35%.

Sole Shareholder

A single individual or entity that holds all the shares of a corporation, essentially owning the company outright.

FMV

Stands for Fair Market Value, which is the price that property would sell for on the open market.

Q8: Refer to the above information.For the year

Q9: Which of the following observations concerning the

Q16: The CML is the pricing relationship between:<br>A)

Q19: The NuPress Valet Co.has an improved version

Q25: A private,not-for-profit hospital received a cash contribution

Q37: The capital balances,prior to the liquidation of

Q41: On January 1,2013 Westman Fuji sold for

Q43: A lawyer works for a firm that

Q51: Which of the following funds use the

Q51: Firms whose revenues are strongly cyclical and