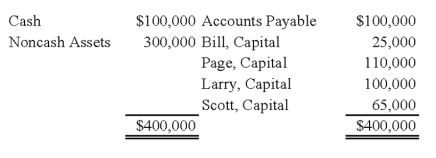

Bill,Page,Larry,and Scott have decided to terminate their partnership.The partnership's balance sheet at the time they decide to wind up is as follows:

During the winding up of the partnership,the other assets are sold for $150,000 and the accounts payable are paid.Page and Larry are personally solvent,but Bill and Scott are personally insolvent.The partners share profits and losses in the ratio of 4:2:1:3.

-Based on the preceding information,what amount will be distributed to Page and Larry upon liquidation of the partnership?

Definitions:

Social Media Tools

Technologies or platforms that facilitate the creation, sharing, and exchange of information and ideas in virtual communities and networks.

Homogenous Sampling

A sampling technique where the selected samples share the same or very similar characteristics, employed to study specific traits or outcomes within a uniform group.

Limitations

Restrictions or boundaries set on activities, capabilities, or functionalities.

Inadequate Sample Sizes

Refers to a situation where the number of observations or data points collected is too small to yield reliable or statistically significant results.

Q1: Refer to the above information.Assuming Perth's local

Q1: Based on the preceding information,what will be

Q2: Based on the preceding information,at the end

Q13: During the fiscal year ended June 30,2009,the

Q14: Based on the preceding information,what is the

Q15: Detroit based Auto Corporation,purchased ancillaries from a

Q16: The CML is the pricing relationship between:<br>A)

Q22: Stone Company reported $100,000,000 of revenues on

Q27: Based on the information provided,what amount of

Q52: On June 30,2009,a voluntary health and welfare