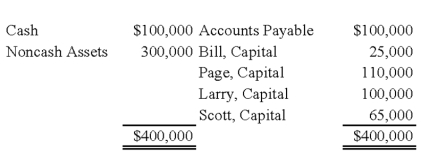

Bill,Page,Larry,and Scott have decided to terminate their partnership.The partnership's balance sheet at the time they decide to wind up is as follows:

During the winding up of the partnership,the other assets are sold for $150,000 and the accounts payable are paid.Page and Larry are personally solvent,but Bill and Scott are personally insolvent.The partners share profits and losses in the ratio of 3:2:1:4.

-Based on the preceding information,what amounts will be distributed to Page and Larry upon liquidation of the partnership?

Definitions:

Quantitative Research

A research methodology that focuses on obtaining data through objective measurements and statistical analysis.

Specific Research Questions

Precise questions that guide a research project, focusing on particular aspects of a topic to be investigated.

Statistics

The science that deals with the collection, analysis, interpretation, and presentation of numerical data.

Knowledge Gained

The information or skills acquired through experience or education.

Q3: The Town of Baker reported the following

Q5: Based on the preceding information,on the statement

Q8: The decision to incorporate must consider the

Q10: Based on the preceding information,in the preparation

Q16: Refer to the above information.Tiffany is paid

Q22: Stone Company reported $100,000,000 of revenues on

Q32: A reorganization value in excess of amounts

Q35: Estimated gross profit rates may be used

Q39: The ABC partnership had net income of

Q54: Refer the information provided above.Assuming the U.S.dollar