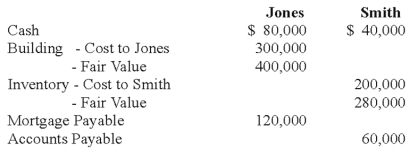

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Cumulative Voting

A voting system used in corporate elections that allows shareholders to accumulate their votes and allocate them to one or several candidates, enhancing minority shareholders' chances of representation.

Revised Act

Refers to an updated or amended legislative act or statute.

Incorporation Statutes

Laws that govern how companies can be legally established, regulated, and dissolved.

Voting Rights

Entitlements granted to shareholders or citizens to vote in corporate or public elections, respectively.

Q1: Which of the following funds should use

Q2: Based on the information given above,what amount

Q4: Based on the information given above,by what

Q5: Toledo Imports,a calendar-year corporation,had the following income

Q5: The separation principle states that an investor

Q6: Based on the preceding information,what is the

Q7: Based on the preceding information,what is the

Q20: Which presentation method combines the component unit's

Q21: The covariance between the IS and DS

Q43: Based on the information given above,the indirect