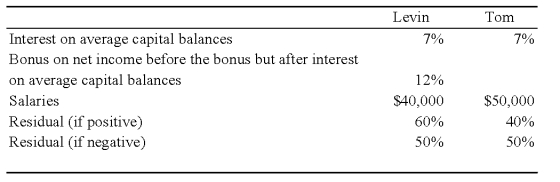

Net income for Levin-Tom partnership for 2009 was $125,000.Levin and Tom have agreed to distribute partnership net income according to the following plan:

Additional Information for 2009 follows:

1.Levin began the year with a capital balance of $75,000.

2.Tom began the year with a capital balance of $100,000.

3.On March 1,Levin invested an additional $25,000 into the partnership.

4.On October 1,Tom invested an additional $20,000 into the partnership.

5.Throughout 2009,each partner withdrew $200 per week in anticipation of partnership net income.The partners agreed that these withdrawals are not to be included in the computation of average capital balances for purposes of income distributions.

Required:

a.Prepare a schedule that discloses the distribution of partnership net income for 2009.Show supporting computations in good form.

b.Prepare the statement of partners' capital at December 31,2009.

c.How would your answer to part a change if all of the provisions of the income distribution plan were the same except that the salaries were $45,000 to Levin and $60,000 to Jack?

Definitions:

CCA Depreciation

CCA Depreciation, or Capital Cost Allowance depreciation, is a method of depreciation used for tax purposes in Canada, allowing businesses to deduct the cost of capital assets over a period of time.

Straight-Line Depreciation

A plan for parceling out the expense of a physical asset throughout its active life in uniform yearly amounts.

Cost-Cutting

The process of reducing operating expenses within a business to improve profitability.

Revenue-Generating

Activities or endeavors that result in the inflow of money to an organization, typically from the sale of goods or services.

Q4: The preparation of which of the following

Q16: The gain or loss on the effective

Q25: Based on the preceding information,in the journal

Q26: Based on the information provided,in Golden Path's

Q29: Based on the preceding information,which of the

Q31: Now suppose you diversify into two securities.Given

Q33: Which of the following items should not

Q38: Prior to closing the accounts at the

Q38: Simon Company has two foreign subsidiaries.One is

Q50: On September 3,2008,Jackson Corporation purchases goods for