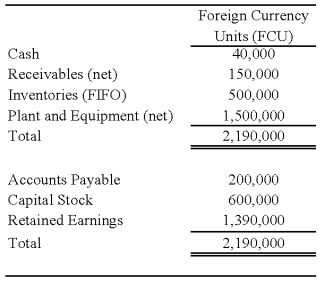

On January 2,2008,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

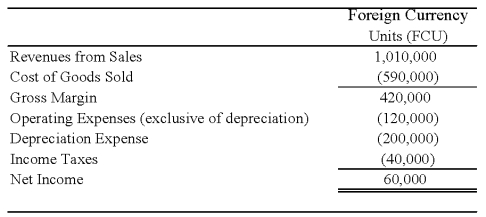

Perth's income statement for 2008 is as follows:

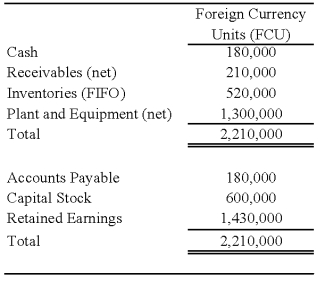

The balance sheet of Perth at December 31,2008,is as follows:

The balance sheet of Perth at December 31,2008,is as follows:

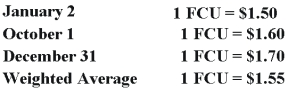

Perth declared and paid a dividend of 20,000 FCU on October 1,2008.Spot rates at various dates for 2008 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 2008.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of patent amortization for 2008 that results from Johnson's acquisition of Perth's stock on January 2,2008.Round your answer to the nearest dollar.

Definitions:

Coping Mechanisms

Strategies or behaviors used by individuals to confront and manage stress, challenges, or trauma in an attempt to maintain psychological well-being.

Suicide Attempt

An act of self-harm with the intention to end one's life, which does not result in death.

Giving Away Possessions

An act often associated with preparation for life changes or mental health issues where individuals distribute personal items to others without an expectation of return.

Q1: Based on the preceding information,what is the

Q1: Refer to the information given above.What amount

Q8: "Basis for measuring investments in financial statements"

Q12: When a capital projects fund transfers a

Q15: FASB issued Interpretation No.46 R related to

Q20: Based on the information provided,what amount will

Q30: Expended 75 percent of the contributions previously

Q37: Five of eight internally reported operating segments

Q43: Based on the preceding information,in the journal

Q104: Transaction: Acquired investments with cash received in