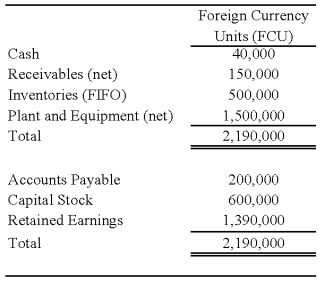

On January 2,2008,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

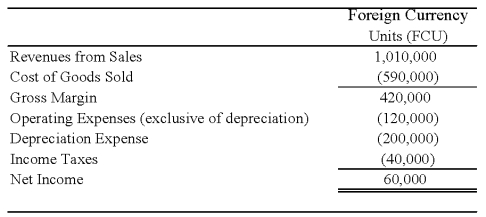

Perth's income statement for 2008 is as follows:

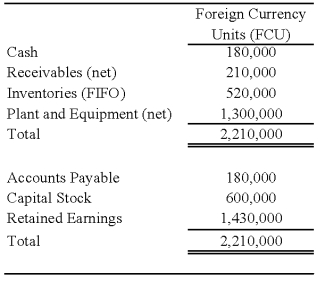

The balance sheet of Perth at December 31,2008,is as follows:

The balance sheet of Perth at December 31,2008,is as follows:

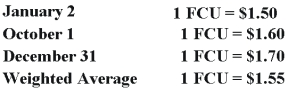

Perth declared and paid a dividend of 20,000 FCU on October 1,2008.Spot rates at various dates for 2008 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 2008.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the amount of patent amortization for 2008 that results from Johnson's acquisition of Perth's stock on January 2,2008?

Definitions:

Primarily Personal

Indicates the use of property or resource predominantly for the owner's personal purposes and enjoyment rather than for business or rental.

Personal/Rental

Relates to property used for both personal and rental purposes, requiring specific tax treatment and allocation of expenses for each use.

Allocate Expenses

The process of assigning costs to specific cost centers or accounts based on their usage or benefit received.

Royalties

Payments made to the owners of intellectual property, such as patents, copyrights, and trademarks, usually based on a percentage of revenue generated from their use.

Q1: Form 8-K

Q15: A special revenue fund should be used

Q19: Based on the preceding information,the entries on

Q25: Based on the preceding information,in the journal

Q26: Based on the preceding information,which of the

Q27: Dish Corporation acquired 100 percent of the

Q38: The general fund of the City of

Q42: Based on the preceding information,what will be

Q63: On the statement of activities for a

Q87: A private college received an offer from