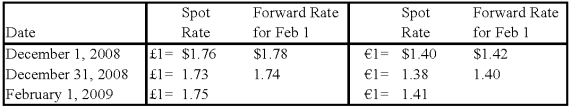

On December 1,2008,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 2008 and 2009.Ignore taxes.

-Based on the preceding information,what is the overall effect of speculation on 2009 net income?

Definitions:

Q18: Required financial statements of funds may include

Q31: Based on the information provided,what amount of

Q32: Based on the information provided,what amount of

Q33: The manifest functions of our society's reliance

Q38: Simon Company has two foreign subsidiaries.One is

Q42: Comment Letter

Q42: Based on the preceding information,what is the

Q42: During the fiscal year ended June 30,2009,an

Q53: Refer to the above information.Assuming Perth's local

Q55: Received cash contributions restricted by donors for