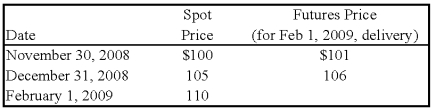

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil.On November 30,2008,AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel,with a February 1,2009,call date.The following is the pricing information for the term of the call:

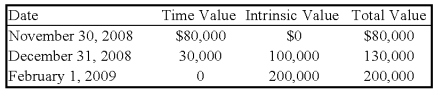

The information for the change in the fair value of the options follows:

On February 1,2009,AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price.On April 1,2009,AMAR sells the oil for $112 per barrel.

-Based on the preceding information,the entries made on April 1,2009 will include:

Definitions:

Binding Arbitration

A legal process in which a dispute is resolved by an arbitrator’s decision, which is final and enforceable by law, with no option for appeal.

Vertical Conflict

A type of conflict that occurs between different levels of the same channel, for example, disputes between a manufacturer and its wholesaler or retailer.

Foot Locker

A global retailer of athletic footwear and apparel, with stores in numerous countries, known for its wide selection of branded sports shoes, clothing, and accessories.

Nike Store

Retail outlets operated by Nike, Inc., offering a range of Nike branded footwear, apparel, and equipment.

Q3: Required:<br>Prepare the eliminating entries needed as of

Q8: Using the preceding information,what amount would have

Q19: Based on the preceding information,all of the

Q28: Which of the following funds are classified

Q39: Based on the information given,what amount will

Q43: Blue Company owns 80 percent of the

Q48: FASB 131 uses a(n)_ approach to the

Q51: Accountants are liable for any materially false

Q56: Discuss major differences between a governmental entity's

Q186: "Stacking" in sports is the pattern by