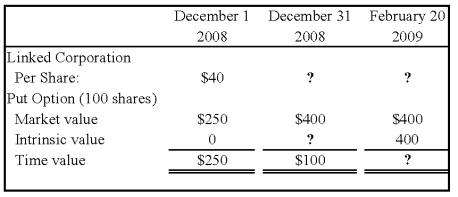

On December 1,2008,Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share.Winston classifies them as available-for-sale securities.On this same date,it decides to hedge against a possible decline in the value of the securities by purchasing,at a cost of $250,an at-the-money put option to sell the 100 shares at $40 per share.The option expires on February 20,2009.Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20,2009.

-Based on the preceding information,which of the following journal entries will be made on February 20,2009?

Definitions:

Right-sided Hemiplegia

Paralysis or severe weakness affecting the right side of the body, often resulting from a brain injury or stroke.

Impaired Transfer Ability

A condition where an individual has difficulty moving from one position or place to another.

Repositioning Patient

The act of adjusting a patient's position in bed or in a chair to promote comfort and prevent complications from immobility.

Abdominal Muscles

A group of muscles in the stomach area that support the trunk, allow movement, and hold organs in place by regulating internal abdominal pressure.

Q10: On January 1,2008,Line Corporation acquired all of

Q10: Refer to the information provided above.David invests

Q16: On the statement of revenues,expenditures,and changes in

Q17: The City of Ames uses the consumption

Q18: In the issuer's annual report,how many years

Q22: Based on the information provided,while preparing the

Q24: A debt service fund of Clifton received

Q38: Rohan Corporation holds assets with a fair

Q41: FASB 131 requires certain disclosures about major

Q43: Based on the preceding information,the amount of