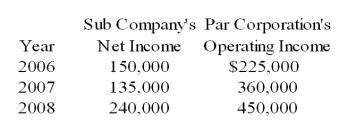

Sub Company sells all its output at 20 percent above cost to Par Corporation.Par purchases all its inventory from Sub.The incomes reported by the companies over the past three years are as follows:

Sub Company sold inventory for $300,000,$262,500 and $337,500 in the years 2006,2007,and 2008 respectively.Par Company reported ending inventory of $105,000,$157,500 and $180,000 for 2006,2007,and 2008 respectively.Par acquired 70 percent of the ownership of Sub on January 1,2006,at underlying book value.The fair value of the noncontrolling interest at the date of acquisition was equal to 30 percent of the book value of Sub Company.

-Based on the information given above,what will be the consolidated net income for 2006?

Definitions:

Segregation of Duties

A risk management and control strategy that divides tasks among different people to reduce the risk of fraud or error.

Cash Register

A cash register is a mechanical or electronic device for registering and calculating transactions at a point of sale, equipped with a drawer for storing cash.

Independent Internal Verification

The audit process within an organization where transactions and processes are reviewed by a person not involved in their execution, aimed at enhancing accuracy and reliability.

Reconciling Bank Statement

The process of ensuring the amounts on a bank statement match the corresponding amounts in a company's financial records.

Q2: Based on the information provided,what is the

Q4: Refer to the above information.Which statement below

Q5: Based on the preceding information,what was the

Q23: Based on the preceding information,what would Gulfstream

Q24: Based on the preceding information,what amount of

Q26: The partnership of X and Y shares

Q31: Refer to the information provided above.Using a

Q33: Based on the information given above,what amount

Q160: College students in the U.S.tend to come

Q170: The United States falls within which category