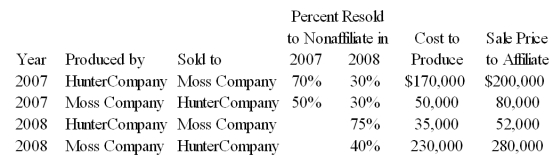

Hunter Company and Moss Company both produce and purchase fabric for resale each period and frequently sell to each other.Since Hunter Company holds 80 percent ownership of Moss Company,Hunter's controller compiled the following information with regard to intercompany transactions between the two companies in 2007 and 2008:

Required:

a.Give the eliminating entries required at December 31,2008,to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b.Compute the amount of cost of goods sold to be reported in the consolidated income statement for 2008.

Definitions:

Reverses Letters

A phenomenon often observed in early childhood and dyslexia where individuals mistakenly interchange letters within words.

IEP

An Individualized Education Program, a document developed for each public school child who needs special education.

Special Needs

A term referring to individuals who require additional or specialized services due to various disabilities or challenges.

Educational Goals

Objectives set within an educational system to guide student learning and achievement.

Q15: Refer to the above information.Which of the

Q24: Based on the information provided,what amount will

Q27: Based on the information provided,what amount of

Q28: Based on the preceding information,what amount of

Q29: On December 31,2008,Mr.and Mrs.Williams owned a parcel

Q34: Based on the preceding information,income tax expense

Q36: Based on the preceding information,in the entry

Q37: Based on the preceding information,the eliminating entry

Q43: Based on the information given above,the indirect

Q77: Building social relationships and creating tens of